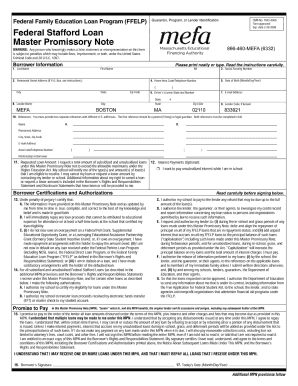

IRS Publication 785 2005-2024 free printable template

Get, Create, Make and Sign

Editing publication 785 online

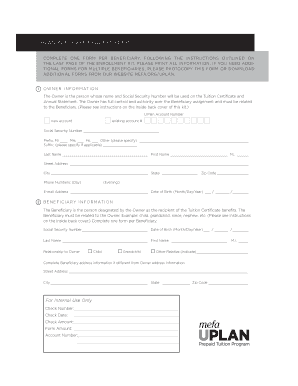

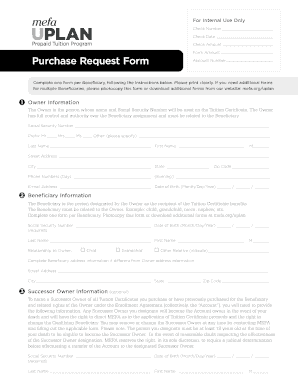

How to fill out publication 785 form

To fill out IRS Publication 785, follow these steps:

Who needs IRS Publication 785?

Video instructions and help with filling out and completing publication 785

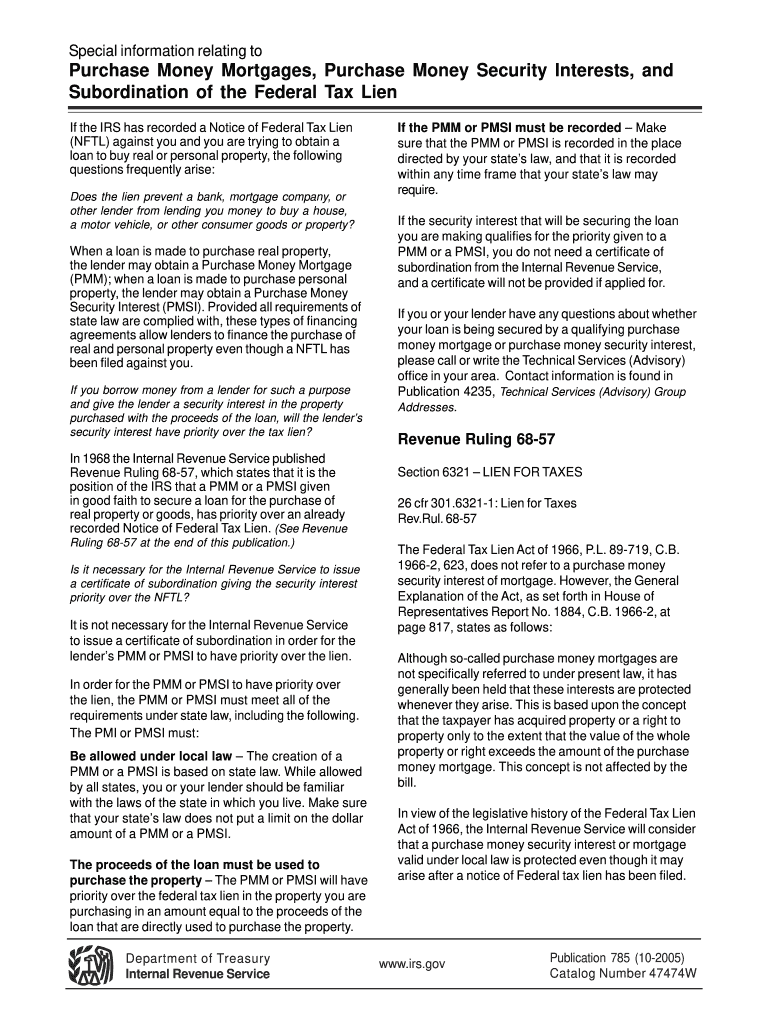

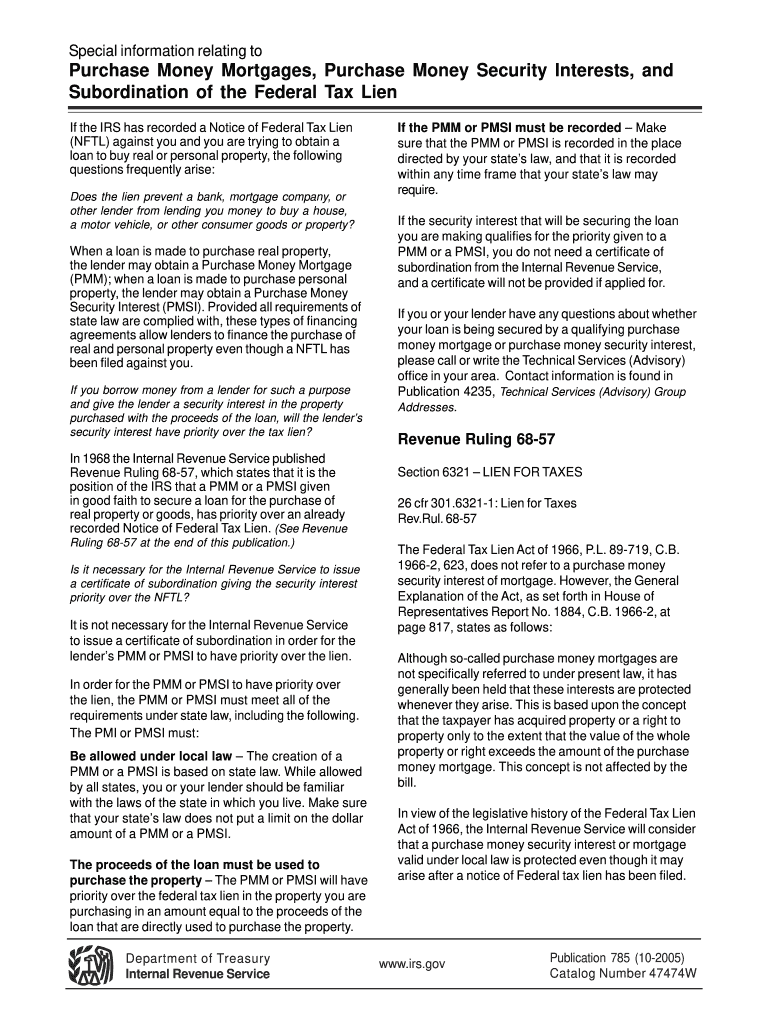

Instructions and Help about irs purchase lien form

Hi this is Tom Scott CPA again today we are talking about understanding federal tax liens and how to get them released welcome back before we begin I want to draw attention to the two buttons on my blog secure for a free tax relief consultation or click here to view my free tax which North's library back to our topic of the day understanding federal tax liens a federal tax lane is the government's legal claim against your property when you neglect your fill to pay tax to the lane protects the government's interest in all your property including real estate personal property and financial assets the federal tax lien exist after the IRS does the following first they put a balance due on their books and assess your liability next they send you a bill that explains how much you owe called a notice of demand for payment, and you neglect or refuse to pay fully to debt in time bears den files a public document called notice of federal tax lien to alert creditors that the government has a legal right to your property Halloween affects you first of all assets a lien attaches to all your assets including real estate securities such as stocks vehicles etc there's also includes future assets required during wife of lien credit one Sarah's files a notice of federal tax lien with your kind of recorder it will limit your ability to get credit they'll make refinancing a home pretty much impossible to get done business the lien attaches to all your business property including any and all of your accounts receivable bankruptcy if you file for bankruptcy your tax debt lean and notice of federal tax lien may continue after the bankruptcy how to get rid of a lien pair tax debt in full this is an easy way to get rid of the federal tax lien the IRS were to lose through the lane within 30 days after you've paid your tax debt discharge of property IRS Publication 783 a discharge removes the lien from a specific property if you are selling a property which has an IRS lien there are several circumstances to have that lien removed to cancel your property it must be in the IRS's best interest to discharge Arlene if there is other property where the lien is covered by 2 times the remaining lien amount after pay down or non-payment the IRS will release the liens to even sell if there is no net value after paying off other senior wings such as more reviews there were leaves the proposed escrow instructions and appraisal on a sale must be submitted to the IRS for approval along with a form 14 135 application for certificate of discharge of property from federal tax lien subordination the subordination does not remove the lane but allows other creditors to move ahead of the IRS, so a refinancing of an existing mortgage can occur this is in to borrowers best interest to improve cash flow and does not harm the IRS Publication 785 gives instructions on how to apply for insubordination withdrawal its withdrawal removes to public notice of federal tax lien and assured that the IRS is...

Fill publication tax lien : Try Risk Free

People Also Ask about publication 785

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your publication 785 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.